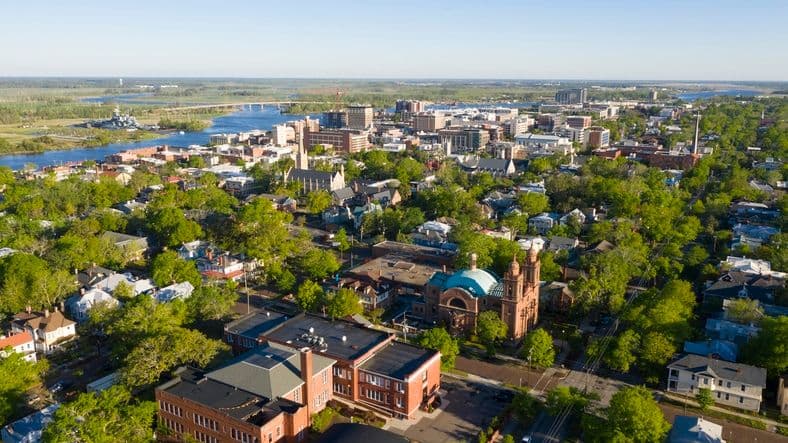

Buyer Demand Remains Firm as Listings Climb in Wilmington Market

June 2025 housing report shows active listings in the Wilmington MSA rose to 4,267, while home sales and median prices continued upward—a sign of a steadily balancing real estate market.

Jul 27 2025

1 min read

Wilmington, NC — The June 2025 housing market report reveals a nuanced outlook: buyer interest remains strong, even as active listings climbed across the Wilmington metropolitan area, signaling a gradual shift from a tight seller’s market toward a more balanced environment.

Market Snapshot: Key Figures from June

- Active listings ended the month at approximately 4,267, up about 1.5% from May, and representing a 27.5% increase over June 2024.

- New listings dipped roughly 20% from the prior month, reaching around 1,332, and are down about 4% compared to last June.

- Pending sales numbered around 1,225, reflecting a 0.2% gain over April and a 17% year-over-year increase.

- Closed sales rose by approximately 6% from May, totaling about 1,152, and are 11% higher than in June 2024.

- Supply of homes available now stands at roughly 3.7 months, compared to 3.2 months a year ago.

- Median sale price climbed to around $434,250, up nearly 9% year over year and about 2.2% from May.

- Homes spent an average of 63 cumulative days on market, a 6% month-to-month decline and 14.6% increase from June a year before.

What This Means for Stakeholders

- Buyers gain slight leverage. As new inventory grows but listing volume slows, some buyers find more choices and less pressure, especially for well-priced homes.

- Sales remain steady. While homes are taking slightly longer to close, consistent pending and closed transactions signal sustained demand—even as the pace slows modestly.

- Pricing continues upward. Median home values are still increasing, indicating affordability pressures remain—but price growth is stabilizing.

- Market balance emerging. With inventory rising and prices steady, the market appears to be shifting from a rapid appreciation cycle toward more stable equilibrium.

Strategic Perspectives

For developers and residential investors, the outlook supports a cautious but opportunistic approach. Stabilizing prices and growing supply may invite interest in new construction, rental housing, or value-add properties, particularly in areas with upward price momentum.

For capital allocators and asset managers, current data offers guidance on underwriting residential deals—benchmarking cap rates, anticipated hold duration, and resale timing as average days on market normalize.

Looking Ahead

With summer underway and new listings lagging April’s push, the market is expected to stabilize further into July. This period will likely shape price trends and sales momentum heading into the fall. Stakeholders should continue watching pricing strategies and days-on-market as early indicators of buyer appetite.

In Summary

The June 2025 housing data shows a Wilmington market that remains fundamentally strong—even as it shifts toward greater balance. Inventory is rising, buyers are still active, and prices are steady. This evolving profile suggests growing opportunity for both buyers and investors entering earlier phases of residential projects or capital deployment.

Daniel Price

Daniel Price brings a decade of experience advising developers and institutional investors on large-scale commercial real estate projects. Now based in Wilmington, he covers local business expansion, leasing trends, and the economics behind downtown redevelopment and land use shifts.

Related Posts

More stories from the same category

Recent Posts

Stay up to date with our latest stories

Protocase and 45Drives Accelerate U.S. Growth with Major Wilmington Expansion

Mayfaire Town Center Adds Nurse‑Led Piercing Studio and Children’s Fashion Store

Subscribe to Newsletter

Provide your email to get email notification when we launch new products or publish new articles